Life Insurance Corporation of India Policy Loan Options

Table of Content

In the initial stages, the interest component is more than the principal. Check for 25 lakh home loan EMI and apply easily on MyMoneyMantra. LIC HFL loan for purchasing a residential plot for construction within 3 years. The loan can be availed for Construction, Extension, Repairs & Renovations.

This loan was sanctioned on time without any hassle. I had given all required documents during verification process. How does my credit score affect the interest rate?

LIC Housing Loan Details

Although our personal/financial situation was less than ideal, Başar was able to secure us an extremely favourable loan. I really doubt another broker could have done as well." Your personal mortgage expert will support you to review and understand all your options. Together with our team of experienced brokers, you will understand the nuances of your situation and fine-tune your mortgage decision. Our engine combines modern finance theory with practical insights from our team of mortgage brokers. Calculate whether you'll have enough income in retirement to maintain your lifestyle in Germany.

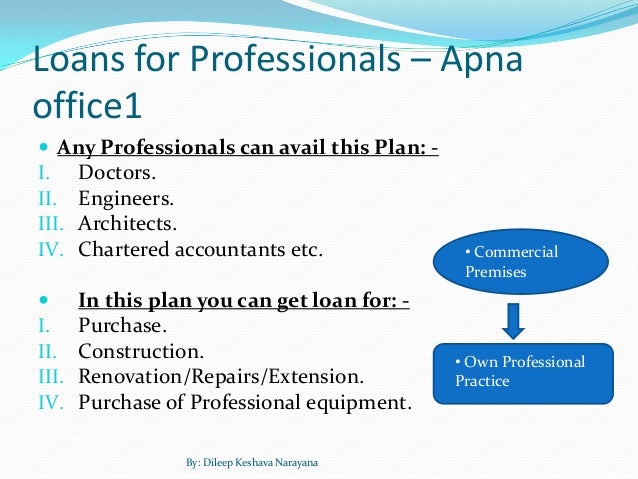

The German mortgage calculator provides, among other things, an overview of the additional purchase costs and monthly repayments resulting from the given mortgage and the duration of financing. Life Insurance of India HFL Home loans exciting features as follows, Skilled Professionals to guide you through the process by providing door step service. Pan India presence and overseas offices at Dubai & Kuwait. Different loan schemes to suit your needs such as loans for Construction / Purchase / Repairs / Renovation / Extension / Plot purchase / Loan against Property / Loans to Professionals etc.

Should you take a housing loan from LIC?

Click on the option ‘pay online’ choose your plan and accept all the terms and conditions you will be sent to the payment gateway. As the name suggests, the fixed rates of interest remain constant for the entire tenure of the loan. The floating rate of interest is linked to external benchmarks that changes every time the Reserve Bank of India changes repo rates.

Yes, according to your credit crore interest rates applied. If you have a good credit score interest rates will be less than a person having a low or average credit score. Home Loan is extended to individuals having pension income with loan tenure upto 80 years of age. Additional benefits are also offered to such borrowers on joint application with children. Home Improvement / renovation loans are available for existing as well as new customers.

What is the minimum salary to apply for a home loan in LIC HFL?

The monthly repayment rate comes from the loan amount, the annual interest rate, and the annual repayment rate. The interest rate is fixed for a certain term. Particularly long fixed interest rates are usually higher. You can pay your EMIs online by logging in to your account on the LIC HFL website in the customer portal.

In other words, your savings component increases, month by month, year by year. Nevertheless, our mortgage calculator is a good start in your search for the best mortgage. In the next step, our financing experts will discuss your financing options with you during a free, no-obligation online consultation, taking into account your situation, wants, and needs.

LIC HFL Home Loan Schemes

Loans are available for purchase of residential plots for construction of house within period of 3 years. Yes, LIC offers loans to partnership firms and companies subject to specific terms and conditions. These entities can avail loan against property in the name of the firms for business purposes.

An individual residing in India, non-resident Indian and pensioners are entitled to avail LIC home loans. Once you've selected your mortgage offer, we will provide you a document checklist that shows all the required document you need to submit. Aside from the real estate agent fees, additional purchase costs are usually paid only by the buyer. Depending on the federal state, the property transfer tax is between 3.5% and 6.5% of the purchase price. Combining this lender know-how with given information and projected information , we evaluate a range of scenarios and outcomes to see how you will fare under different conditions. We discuss the outcomes and logic of the recommendations with you.

G. I understand that in order to deliver the product to me, I hereby authorize Wishfin, to obtain my Consumer Credit Information from TUCL. C. I hereby expressly grant unconditional consent to, and direct, TUCL to deliver and / or transfer my Consumer Credit Information to the Company on my behalf. For purchase of ready to move homes or under construction ones. Note that Pay When You Stay, 6 EMI Waiver and Advantage Plus are part of LIC HFL’s special offers.

Totally, i'm satisfied with the loan service provided by LIC. In other bank, there are lots of documentation process but in LIC, the document process is very less. Within 3 days, they have sanctioned the loan. I got the loan amount of Rs. 14.5 lakhs and i bought it 16 years back and the total tenure period of the loan is 20 years. I have taken Home Loan directly through LIC Housing Finance. The rate of interest was 9.7% compare to market take little bit higher and their processing fee was fine.

Hence, it is better to seek the guidance of a professional loan serve like MyMoneyMantra when apply for financing. We help you prepare for documents without any fee. The faster you submit the documents, the quicker is LIC Home Loan process for approval.

An acknowledgement SMS and e-mail will be sent to the mobile/e-mail id provided in the registration form. After the documents are uploaded, click on submit the request. The file size of the scanned image should be maximum 100 KB. Follow simple 3 step process-Registration, Printing and Uploading of documents.

The more equity or savings you bring in, the lower your loan-to-value ratio LTV and hence the interest rate at which the bank grants you your mortgage. Typically, banks lower the interest rate gradually in 5% steps of the LTV. In other words, a higher down payment means a lower LTV and a lower interest rate, and vice versa, a lower down payment means a higher interest rate due to a higher LTV.

Comments

Post a Comment