LIC Home Loan at very low interest rate, Apply online at lichousing com

Table of Content

In your secure online account, you can easily upload your required personal, property and mortgage documents to get approved faster than traditional brokers. This annuity payment consists of both interest and principal repayment. The composition of interest and repayment changes slightly with each month.

Please submit your Discharged Receipt in Form No.3825 with original policy document atleast one month before the due date so that the payment is received before the due date of maturity claim. This option will provide details of any claim paid under the policy with NEFT/cheque details, date of payment and amount of payment. Total bonus accumulated under the policy will be displayed. This bonus is payable only at the time of final payment under the policy. Basic details of policy will be displayed such as Plan-Term, Sum Assured, Date of Commencement, First unpaid premium etc. For policies on the life of spouse, separate registration will be required to be done by him/her.

LICHF Home Loan FAQs

Loan Approval based on your financials to help you choose property as per your Budget. Top up Loan is additional loan over and above base home loan available for balance transfer cases to existing customers. When you take a Home Loan for constructing a house, LICHFL gives you a repayment holiday known as the moratorium during the construction period.

However, German banks have different guidelines when it comes to rating the creditworthiness of applicants for a mortgage. For us to find the best mortgage for you, we need more information about you, your financial situation, and your future plans. With this information, our financing experts can explain your possible options in detail and provide a free personalized mortgage recommendation. After entering this data into the German mortgage calculator, we calculate the estimated loan amount, interest rate, and monthly repayment rate.

Documents Required

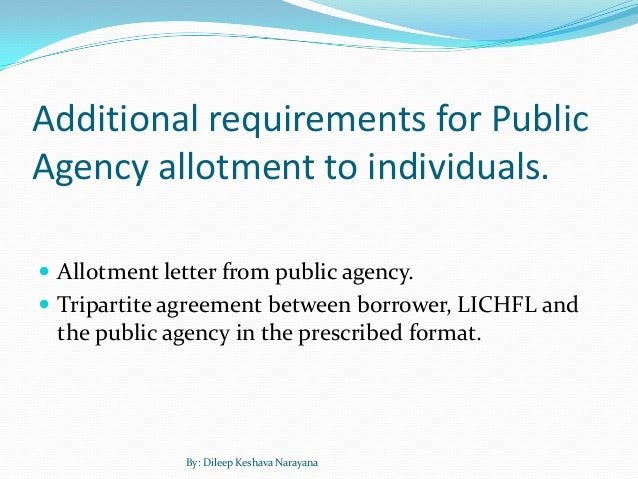

In case of flats, allotment letter, sale agreement of builder/society. Home loans are available for individuals working abroad but willing to own a residential property in India. It depends on your requirements and the accuracy of your documents.

In other words, your savings component increases, month by month, year by year. Nevertheless, our mortgage calculator is a good start in your search for the best mortgage. In the next step, our financing experts will discuss your financing options with you during a free, no-obligation online consultation, taking into account your situation, wants, and needs.

Apply for Lowest Home Loan Online @ Rs. 751/Lakh* EMI

Therefore, the floating rates keep changing every three months. You can also try LIC Home Loan Interest Rate Calculator for assessing loan affordability. Using these calculators, you can make an informed decision about amount, rate and tenure. Further to ease your borrowing journey you can instantly apply online from MyMoneyMantra website after deciding on loan parameters. An applicant with a monthly salary of INR 80,000 can apply for a home loan from LIC housing finance up to INR 1 Crores approximately depending on the tenure of the home loan.

Tick “I accept all terms and conditions of LICHFL”. You will be redirected to Payment Gateway site. Upon payment through netbanking, payment summary will be shown. LIC HFL offers a variety of home loan schemes for salaried and self-employed individuals. Listed below are all the home loan schemes which can be availed by the customers. This German mortgage calculator is designed to help you determine the estimated amount you can get from over 750 mortgage lenders in Germany.

Interest Rates Based on Loan Quantum & CIBIL Score for Salaried & Professionals and Non-Salaried & Non Professionals

Employee named piyali das posted at chowringhee sq branch was involved with the branch manager. They ensured the delay of my loan transfer on arious pretexts. The rae of interest never falls once youbtake loan. I have taken home loan directly through LIC Housing Finance Ltd. How can I change the interest rate for LICHFL home loan? You can change the interest rate for the home loan availed from LICHFL by logging into the customer portal.

Yes, you can apply for LIC Home Loan online and it is more affordable convenient to apply online. When you apply through MyMoneyMantra, we directly share your application with the NBFC and the processing starts instantly. Also our loan representative will be available to guide you at free of cost till loan disbursement. You are just a few clicks away from the best Home Loan offer in your city. Currently home loan interest rate starts at 8.00% p.a for all loan amounts. Share your name, mobile number & email to check your eligibility and get a list of most affordable home loan schemes.

They have taken 1 week to sanctioned the loan. Documentation process is as usual like other banks. They have provided me a interest rate of 8.45%. Yes, you can make the payment of your LIC HFL Home Loan EMI online. It can be done by logging into the customer portal.

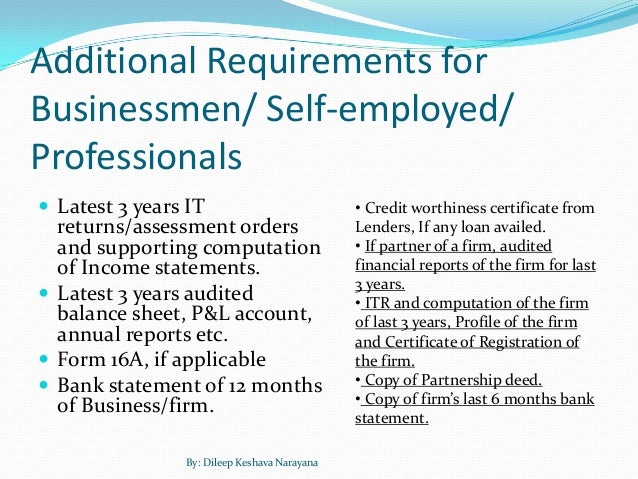

Last 3 years income tax returns, P/L account, Balance sheet and all other necessary documents along with financials (For self-employed). No, it is not compulsory to own an LIC policy for LIC Home Loan. However, it is advisable to get insurance coverage when you apply for the LIC Home Loan. You can take insurance for your property as well as Home Loan. With loan insurance, your family is protected financially against extreme emergency involving death of the main applicant.

Comments

Post a Comment